Integrated Financial Settlements Reaffirms Commitment to Data Security with Renewed Attestations GREENWOOD VILLAGE, CO (November 27, 2024) – Integrated Financial Settlements (IFS), a leader in structured settlement services, is proud to announce that it has once again achieved SOC 2 Type 2, SOC 3, and HIPAA HITECH Type 2 attestations. This milestone encompasses IFS and […]

Blog

Philips Respironics CPAP Litigation Settlements: Maximize Your Earnings with Fee Structure Plus (FSP)

As the Philips Respironics CPAP litigation gains momentum, contingency fee attorneys stand to earn significant settlements. Due to dangerous health risks, Philips Respironics recalled millions of its CPAP, BiPAP, and ventilator devices. The polyester-based polyurethane (PE-PUR) foam used in these machines can break down and release toxic particles into users’ airways, potentially causing cancer, respiratory […]

Is the Structured Settlement Industry Stronger Than Ever? Insightful Perspectives from Robert Lee and Peter Jachym

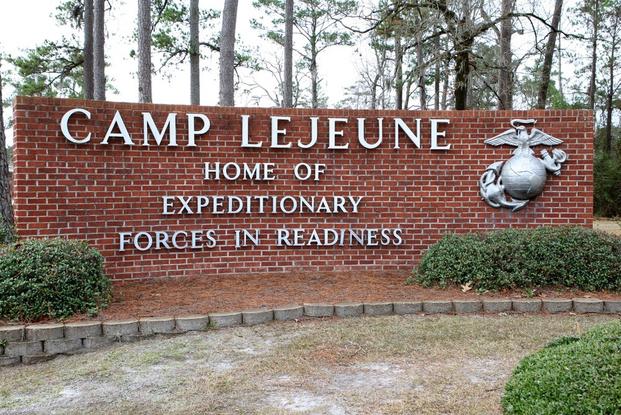

Camp Lejeune Lawsuit – Claims & Settlements

Camp Lejeune Settlements Over 546,500 claims for compensation related to the contaminated water at the Marine Corps Camp Lejeune base have been filed.[…]

Attorney Fee Deferral: A Smart Strategy for Plaintiff Attorneys

As a plaintiff attorney, managing the financial impact of large contingency fees can be challenging. One effective strategy to consider is attorney fee deferral, which allows you to delay receiving your fees and, consequently, delay the associated tax liabilities. By deferring fees, you have the opportunity to allocate your earnings into various tax-advantaged investment vehicles. […]